Group Exemption Fact Sheet, Help for Tax-Exempt Subordinates

What is IRS tax exempt status?

Under the United States federal tax law, organizations that meet specific requirements may claim exemption from paying federal income tax. This means that these tax-exempt organizations do not have to pay federal income tax on the earnings of the organization. However, these organizations must still file an IRS tax return (sometimes called an “information return” because no tax is paid) to tell the IRS about the group’s income, expenses, and key activities.

The requirements to qualify for federal tax exemption are set out in the Internal Revenue Code (IRC), primarily in Section 501(c). Interestingly, the law provides that any organization that meets the requirements is tax-exempt. However, claiming tax-exempt status without also obtaining recognition from the Internal Revenue Service (IRS), does little good. IRS recognition and including the organization in the IRS’ Business Master File (BMF) of exempt organizations is needed to obtain the benefits of tax-exempt status.

Two-ways to obtain IRS recognition of tax-exempt status

- Traditional method. The most common way to obtain IRS recognition of tax-exempt status is to apply to the IRS on the appropriate IRS Form. There are three main forms: 1023EZ, 1023, and 1024. Small, charitable organizations with anticipated total income of $50,000 or less may use Form 1023EZ. Larger charitable organizations file form 1023. Other types of tax-exempt organizations (business leagues/trade associations, unions, social clubs, social welfare organizations) file Form 1024.

- Join a group. The second way to obtain IRS recognition of tax-exempt status is under an IRS group ruling.

What is an IRS group ruling?

For the “administrative convenience” of the IRS, the IRS created a process by which a “parent organization” may add its “subordinate organizations” to the IRS records. This process allows the subordinate organizations to obtain IRS tax-exempt status without filing an IRS form 1023 or 1024 and paying the IRS fee to apply. The process also frees the IRS from reviewing hundreds, and sometimes thousands, of nearly identical exemption applications of the subordinates of a parent organization.

How Parent Booster USA (PBUSA)’s group exemption works

PBUSA was granted a group ruling by the IRS in 2005. To obtain IRS tax-exempt status under PBUSA’s group exemption, a PTO (parent teacher organization) or school booster club completes PBUSA’s online application and submits the joining fee. PBUSA reviews the application to make sure the organization meets requirements to be a 501(c)(3) organization under PBUSA’s group exemption. After PBUSA approves the application, PBUSA helps the organization to incorporate and obtain an employer identification number (EIN). The EIN is the taxpayer identification number issued and used by the IRS to identify entities to the IRS. Once the organization has an EIN, PBUSA submits the new member to the IRS to be added to the IRS BMF (tax-exempt organization list).

Under PBUSA’s group ruling, all of PBUSA’s members must be organizations that: (1) support the activities of a school, including school bands, sports, and other activities; (2) engage in activities such as hosting meetings between parents and teachers, increasing volunteers at the school, hosting activities at the school, and fundraising; and (3) have similar provisions in their articles of incorporation and bylaws.

Under PBUSA’s group ruling, all of PBUSA’s members must be organizations that: (1) support the activities of a school, including school bands, sports, and other activities; (2) engage in activities such as hosting meetings between parents and teachers, increasing volunteers at the school, hosting activities at the school, and fundraising; and (3) have similar provisions in their articles of incorporation and bylaws.

PBUSA currently has over 4000 members (i.e., subordinates).

Benefits of PBUSA’s group exemption

Once an organization obtains IRS recognition of tax-exempt status, either by applying individually or under a group ruling, there are more requirements to maintain federal tax-exempt status and comply with state nonprofit rules. A benefit of joining PBUSA and obtaining tax exemption under its group ruling is that PBUSA helps make sure that its members meet the additional requirements.

How does PBUSA keep track of its 4000+ members?

Great question! We are quite proud of PBUSA’s systems and methods to help make sure our members file all the required paperwork to maintain their nonprofit status.

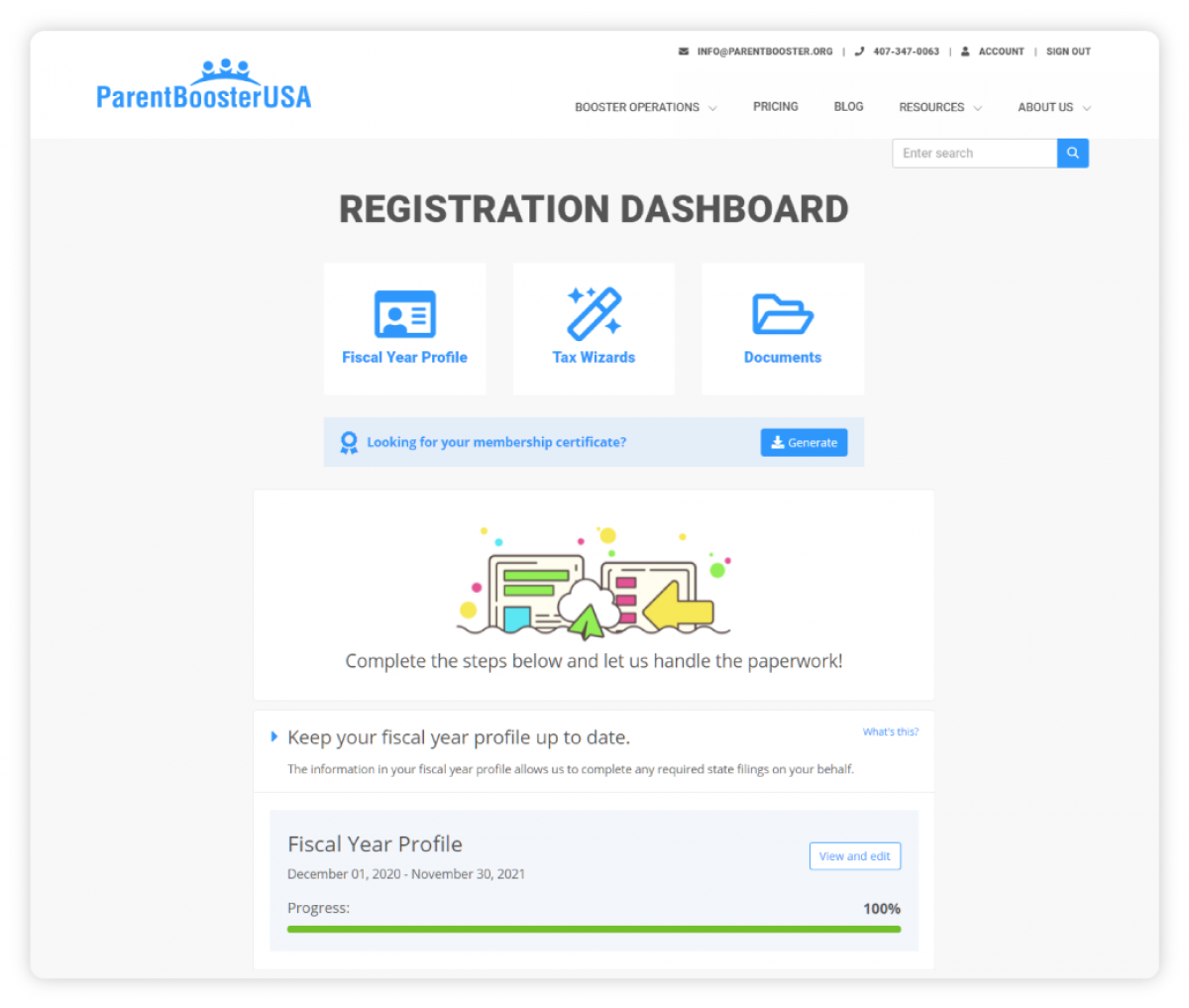

PBUSA files the required state and federal paperwork for its members. However, to keep its members in the know about what needs to be filed and when, members may access an online dashboard. The dashboard shows members at-a-glance the filings required by their state and the IRS, what was filed last, and what is due next.

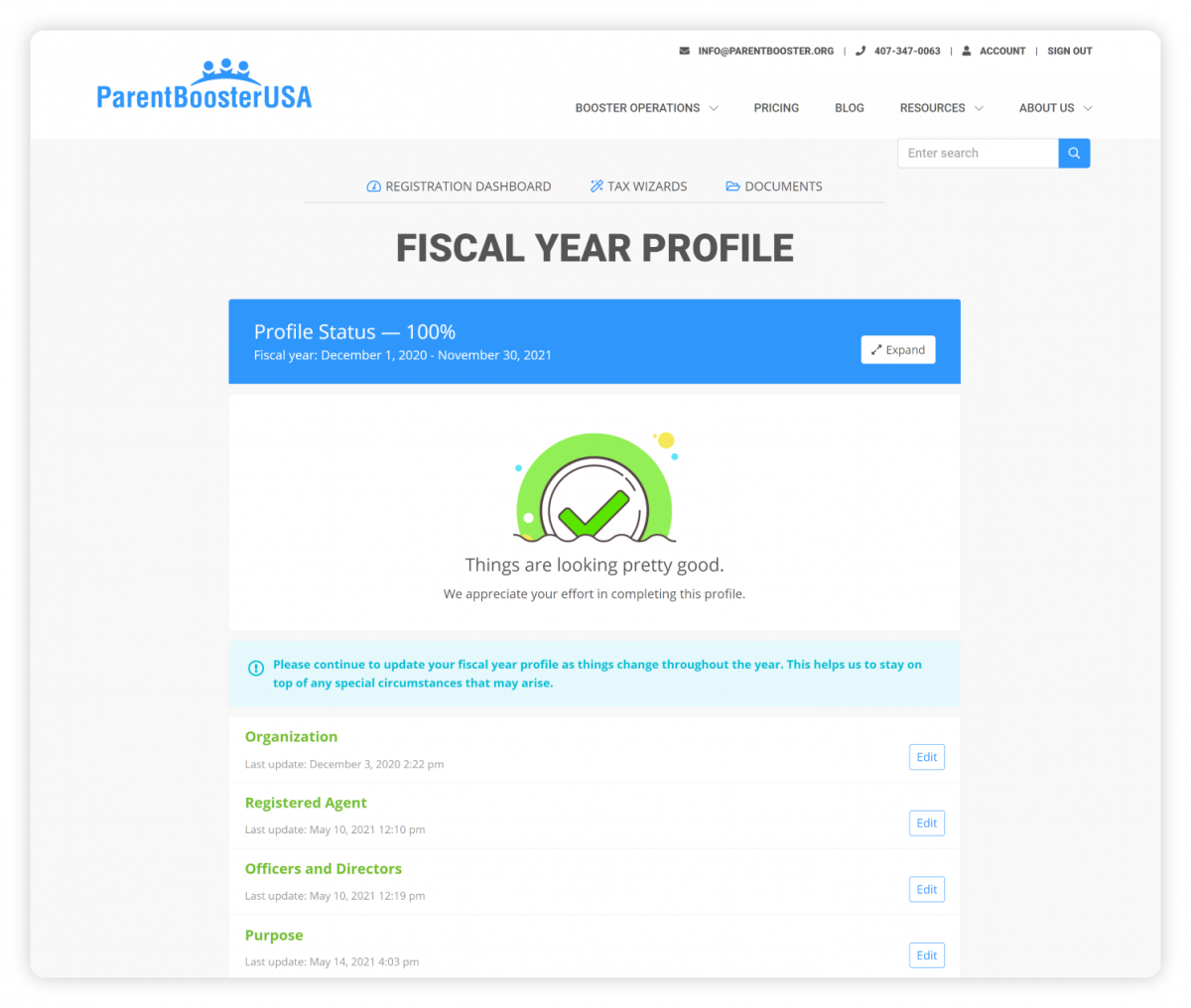

PBUSA also must gather information about its members' officers, directors, activities, and finances to file all the government paperwork. We use an online “fiscal year profile” to gather the information. It walks members through what we need and makes it easy to supply the information.

In addition, PBUSA sends reminders by email, text, and phone to let PBUSA’s members know when filings are coming up and if more information is needed to allow PBUSA to make the filings. It’s really slick if we do say so ourselves!

Keeping the IRS up to date on PBUSA’s members

There are a lot of moving parts to make sure PBUSA’s members are included in the IRS master file of exempt organizations (BMF).

The IRS requires group exemption holders, like PBUSA, to provide an updated list of their members once per year. But because PBUSA wants to get its new members onto the IRS list sooner, PBUSA sends an update to the IRS four (4) times each year, once per quarter.

With over 4,000 members, the process is complicated. The IRS doesn’t always get all the new members that are submitted at the same time, added at the same time. Sometimes the IRS makes mistakes in names, EINs, and other information when adding members to the IRS list. No worries. PBUSA keeps an eye on the IRS list to make sure its members are on it. PBUSA’s technology wizard, Matt, has created an amazing system to help us do the complicated work.

Group exemption challenges

We are quite proud of how PBUSA manages its group exemption. There are, however, a few challenges.

Two big challenges are (1) how the IRS lists group member names and (2) IRS mistakes.

The name challenge. The IRS tax-exempt organizations list, or BMF, is a giant spreadsheet. The spreadsheet has 29 columns. Using Excel makes labeling the columns a little easier than the official IRS names. Excel adds alphabetic labels to the existing columns from the BMF, A-Z, AA, and AB. Member/subordinates’ EINs are listed first in column A, the parent organization name (PBUSA) is listed in column B, and the member/subordinate name is listed in the last column, column AB.

Most online grant application systems, including those for Disney, Walmart, and Kohl’s, and charity watch organizations like GuideStar, pull their data from the IRS list. However, these databases typically pull the EIN from column A, and the parent name (PBUSA) from column B but do not pull the member/subordinate name from column AB. This results in organizations under a group ruling being listed member/subordinate’s EIN, and the parent organization (PBUSA) name.

If you need to validate your 501(c)(3) status under PBUSA’s group exemption, you may provide donors with your PBUSA membership certificate. The certificate includes a brief explanation of the group exemption. PBUSA staff also are happy to help, including writing and/or calling donors who have questions.

PBUSA members are separate nonprofit corporations with their own EINs. This means donors should make donations directly to your organization, under your group’s name and EIN.

PBUSA provides a variety of additional resources on its website to help your organization raise money and validate your 501(c)(3) status including:

- Tips for grant applications (applying for Disney, Walmart and Kohl’s grants)

- Updating your GuideStar Profile

- PBUSA IRS determination/affirmation letter

- PBUSA group exemption letter

IRS mistakes. The IRS uses a manual process to add group members to its list of tax-exempt organizations. As with any manual entry process, mistakes are made. PBUSA has found members under an incorrect parent name, with misspellings in the members’ names, incorrect EINs, and the like. Fortunately, our systems and staff monitor the IRS list to find mistakes and we work with the IRS to make corrections. (IRS mistakes are not unique to group exemptions. The IRS is understaffed and under-resourced. Many practitioners who work with the IRS deal with IRS errors on a regular basis.)

PBUSA manages one of the largest group exemptions in the country. To keep track of its thousands of members, and ensure that its members’ state and federal documents are filed on time, PBUSA uses customized systems and has a dedicated staff knowledgeable about nonprofit rules. Visit our website to learn more about Parent Booster USA and find many free resources on how to manage a school support organization.

The only organization of its kind in the US, Parent Booster USA is about helping school support organizations (parent teacher organizations, high school booster clubs and other school fundraising groups) handle the state and federal government paperwork required of fundraising groups.

Founded in 2004 by an attorney skilled in nonprofit and tax law, Parent Booster USA has more than 6,000 member organizations in 50 states and DC with a 95% annual renewal rate. We provide peace of mind for parent volunteers, school administrators and school district leadership.